12 lut 2016 | Weingarten

CHG-MERIDIAN looks back on a successful year

Growth: funding for more technology investments than ever before

All-time high: a record amount of equipment certified data-erased and remarketed

Acquisition: IT and healthcare portfolio acquired from GE Capital in northern Europe

Finance and technology manager CHG-MERIDIAN, which is headquartered in the southern German town of Weingarten and has 40 branch offices in 23 countries worldwide, can look back on an encouraging financial year. Of particular note was the record level of gross profit, which can be attributed to buoyant growth in highly promising areas of business such as certified data erasure, income from other services, and improvements in the remarketing of equipment. Moreover, CHG-MERIDIAN acquired an IT and healthcare portfolio in Northern Europe.

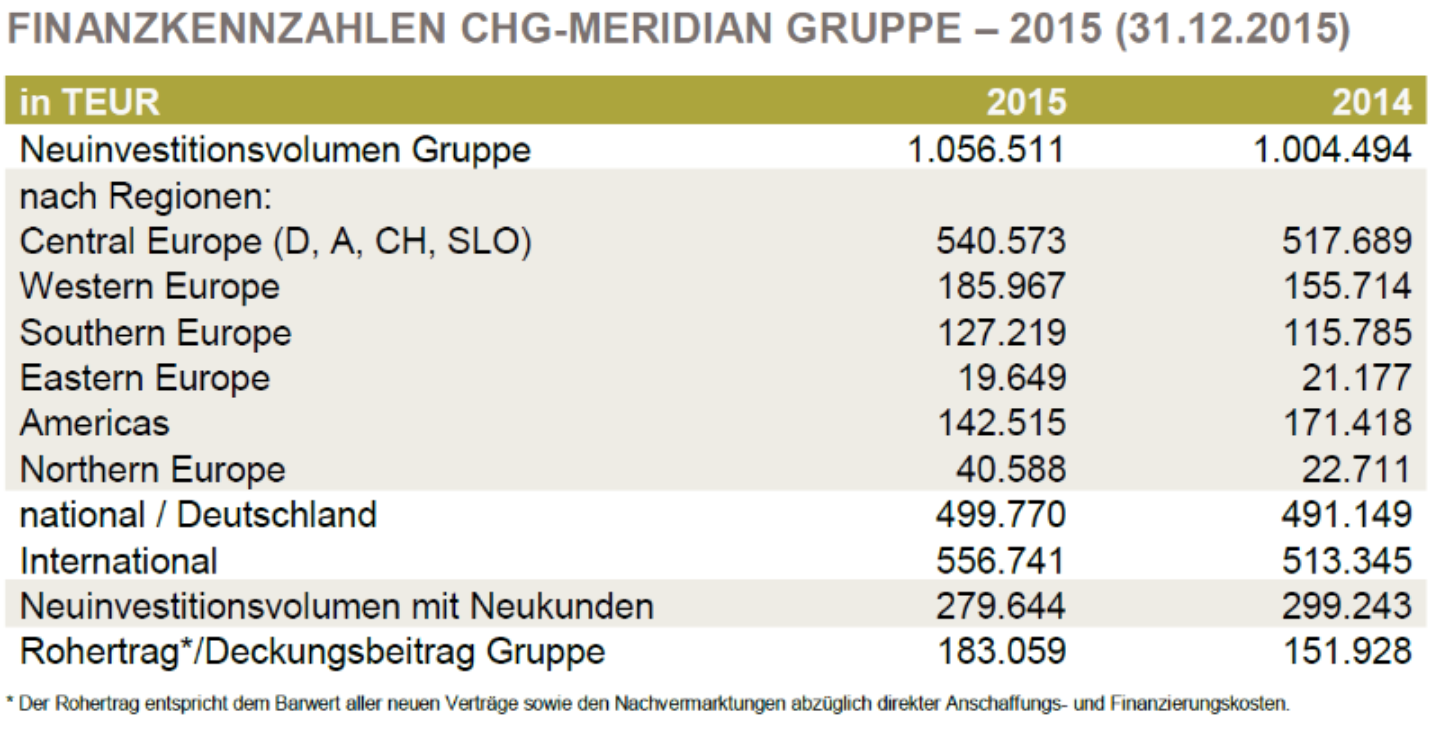

Worldwide, the volume of leases originated was up by 5.2 percent to almost €1.057 billion (2014: €1.004 billion). The reduced volume in North America and Eastern Europe was offset by stable growth in Central and Southern Europe and above-average growth in western Europe.

Customer loyalty boosts growth

Rising by 7.5 percent, the number of leases in force passed the 70,000 mark for the first time (2014: 65,369 leases). Both the number of active customers and the number of leases in force as at the reporting date of December 31, 2015 had increased significantly. CHG-MERIDIAN had 11,513 active customers last year, an advance of 6.9 percent compared with the previous year (2014: 10,766 customers). "In 2015, we unlocked significant growth potential among new and existing customers alike thanks to our new products and enhanced services. That is a sign of trust, quality, and customer satisfaction," said Jürgen Mossakowski.

490,000 items of remarketed IT-equipment

A substantial proportion of total returns can be attributed to the highly encouraging results from the remarketing of IT equipment. Selling used equipment at the end of its useful life not only generates additional income but also reflects the Company's philosophy of conserving resources and operating sustainably. In 2015, CHG-MERIDIAN remarketed over 490,000 items of IT-equipment, 7.5 percent more than in the previous year (2014: 456,000 items).

Focus on data protection: certified data erasure with at record level

The eraSURE® one-stop solution for the certified erasure of data from used equipment is one of the competitive and end-to-end services in the CHG-MERIDIAN solutions portfolio. Sales of the service gained additional momentum last year due to companies' growing awareness of data protection and data security issues. Data erasure was performed on 106,071 items of equipment, using either a TÜV-certified or a DEKRA-certified method and tailored to the individual security requirements. In 2014, 102,000 items had undergone a certified data erasure process, equating to a year-on-year increase of 3.5 percent.

Substantial IT and healthcare portfolio acquired from GE Capital in Northern Europe

On February 1, 2016, CHG-MERIDIAN successfully acquired an IT and healthcare portfolio in northern Europe. The original acquisition cost of the assets in the portfolio totaled €22.5 million. The customer portfolio was obtained from GE Capital in Norway, Sweden, Denmark, and Finland. In Norway, the transaction was completed together with DNB, the largest financial services group in Norway. The portfolio significantly strengthens CHG-MERIDIAN's market presence in Northern Europe and represents a logical continuation of its growth strategy. CHG-MERIDIAN has been present in the four Nordic countries since 2014, when it acquired the former ACENTO AS (Oslo, Norway). "Purchasing the portfolio will provide a long-term boost for our existing sales activities in the IT and healthcare sectors. It also widens our market reach in Northern Europe," said Jürgen Mossakowski at the annual press conference.

Record profitability achieved

The CHG-MERIDIAN Group saw a further rise in the profitability of its business. Gross profit was up by around 20 percent to €183 million (2014: €152 million), growing nearly four times as quickly as the volume of lease originations. "This result can be attributed to our strong market position and our strategy of focusing consistently on profitability when it comes to new business," explained Mossakowski.

The interest-rate environment also had a positive impact on income in 2015. In addition to two syndicated loans totaling €70 million in August, a bonded loan of over €50 million was issued. CHG-MERIDIAN was able to obtain conditions at the lower end of the offered range thanks to high levels of liquidity in the financial markets and the Company's excellent reputation as a high-quality borrower.